-

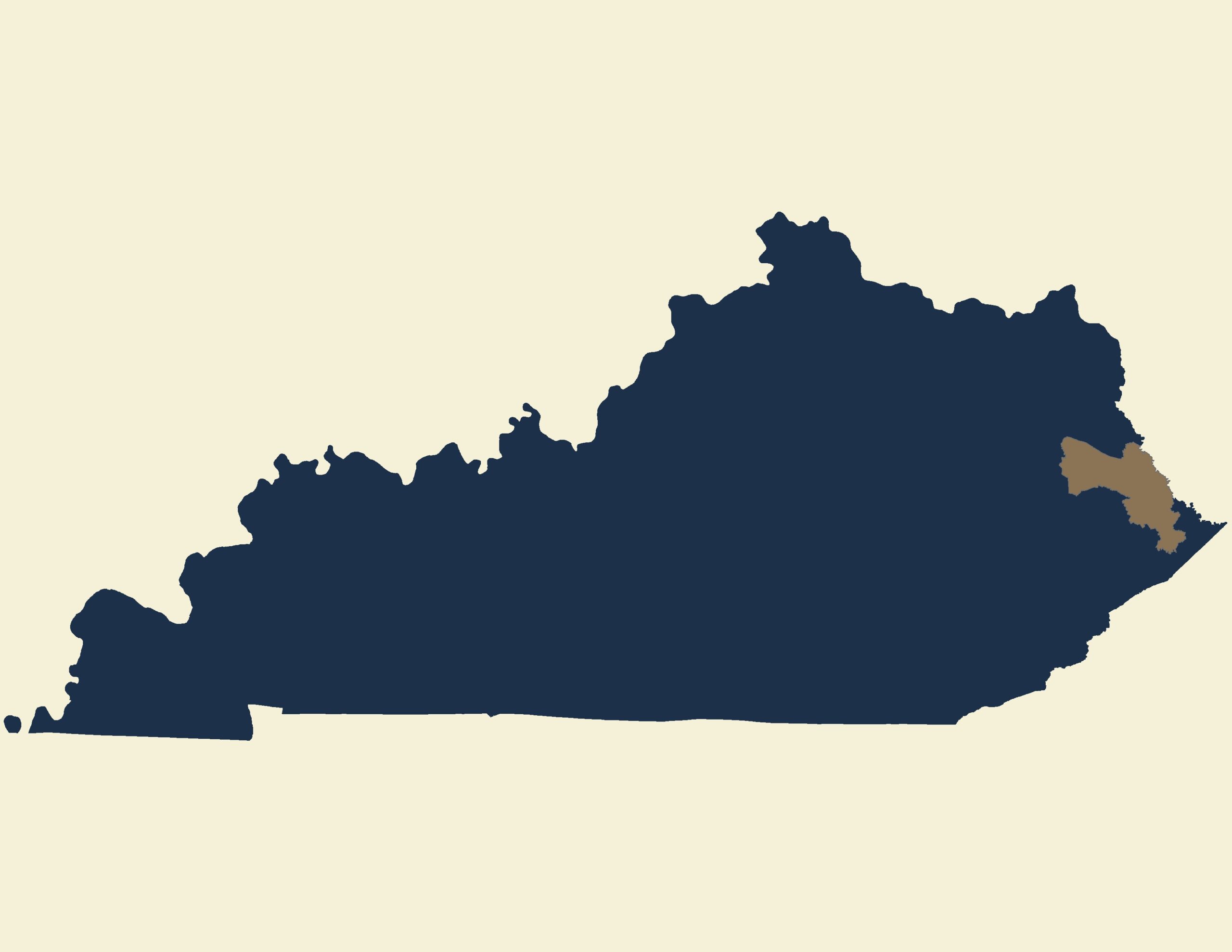

Kentucky’s real property tax rate drops for fourth consecutive year

FRANKFORT — Kentucky’s real property tax rate has dropped for the fourth consecutive year, decreasing to 10.9 cents per $100 of assessed value in 2024, Gov. Andy Beshear announced Thursday. State law requires the Kentucky Department of Revenue to set the real property rate no later than July 1 of each year. The tax rate

-

Extension district sets tax rates

BY ROGER SMITH MOUNTAIN CITIZEN INEZ — The Martin County Extension District set 2024 property tax rates in a meeting Sept. 12. Taxpayers can expect to be billed 13.1 cents per $100 of assessed value on real property, 24.5 cents per $100 on personal property and 2.2 cents per $100 on motor vehicles. According to board

-

BOE retains current property tax rate for 2024

BY ROGER SMITH MOUNTAIN CITIZEN INEZ — The Martin County Board of Education declared its decision to maintain the existing property and motor vehicle tax rates for the upcoming year. The real and personal property rate will continue at 84.6 cents for every $100 of assessed value. The motor vehicle tax rate will stand at

-

Clerk explains new taxation on campers

Campers defined and taxed as ‘motor vehicles’ BY ROGER SMITH MOUNTAIN CITIZEN INEZ — Kentucky has expanded its statutory definition of “motor vehicle” to include recreational vehicles, even nonmotorized ones, in a significant shift in tax liability. In an interview last week, Martin County Clerk Susie Skyles explained what this change means to residents. “As

-

Legislative Update: Why lower income taxes?

BY REPRESENTATIVE BOBBY MCCOOL Before I begin this week’s legislative update, I want to thank everyone who took the time to complete my legislative questionnaire. As I read through the responses, I noticed that someone asked, “Why do we want to lower income taxes?” and thought I might answer it in this column. The fact

-

Warfield lowers tax rate

BY ROGER SMITHMOUNTAIN CITIZEN WARFIELD — The Warfield City Commission voted Thursday to lower the property tax rate for fiscal year 2022-2023. The rate drops from 9.8 cents to 9.6 cents per $100 of assessed value on real, personal and tangible property, excluding motor vehicles and watercraft. Honoring military hero The commission will honor the